Challenges in the Finance Industry

Regulatory Compliance

Constantly evolving regulations increase operational complexities.

Regulatory Compliance

Cybersecurity Threats

Growing digital transformation has heightened data breach risks.

Cybersecurity Threats

Market Volatility

Economic uncertainty and fluctuating markets impact investment returns.

Market Volatility

Technological Disruption

Adapting to innovations like blockchain, AI, and fintech integration.

Technological Disruption

Customer Expectations

Demand for personalized services and seamless digital experiences.

Data Security & Privacy

Opportunities in the Finance Industry

Digital Transformation

Adoption of fintech solutions to improve customer experience and operational efficiency.

AI & Automation

Enhancing fraud detection, customer service, and predictive analytics through advanced technologies.

Big Data & Analytics

Using data-driven insights for better decision-making and risk management.

Sustainable Finance

Rising interest in green finance and ESG (Environmental, Social, and Governance) investments.

How We Help Finance Businesses

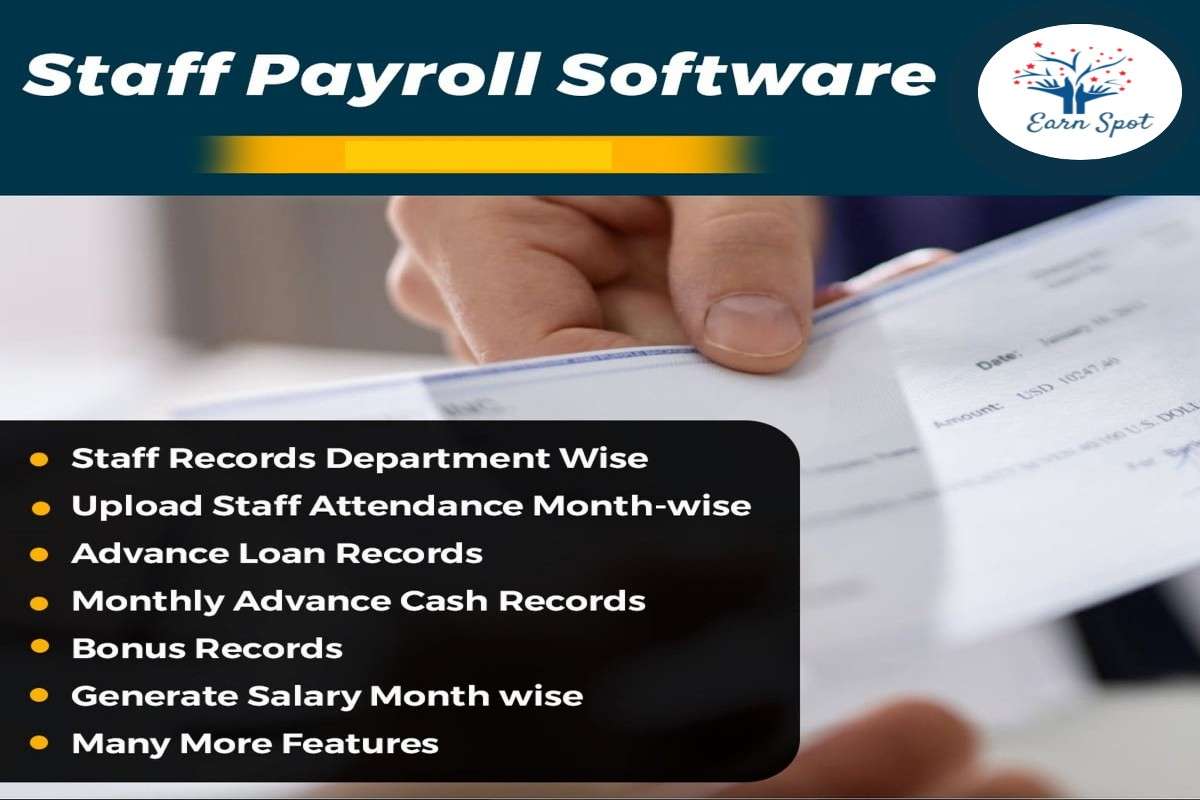

Staff Payroll (Human Resource Management)

Optimize your HR processes with our advanced HRM software. Streamline recruitment, manage employee records, and enhance productivity with intuitive tools...

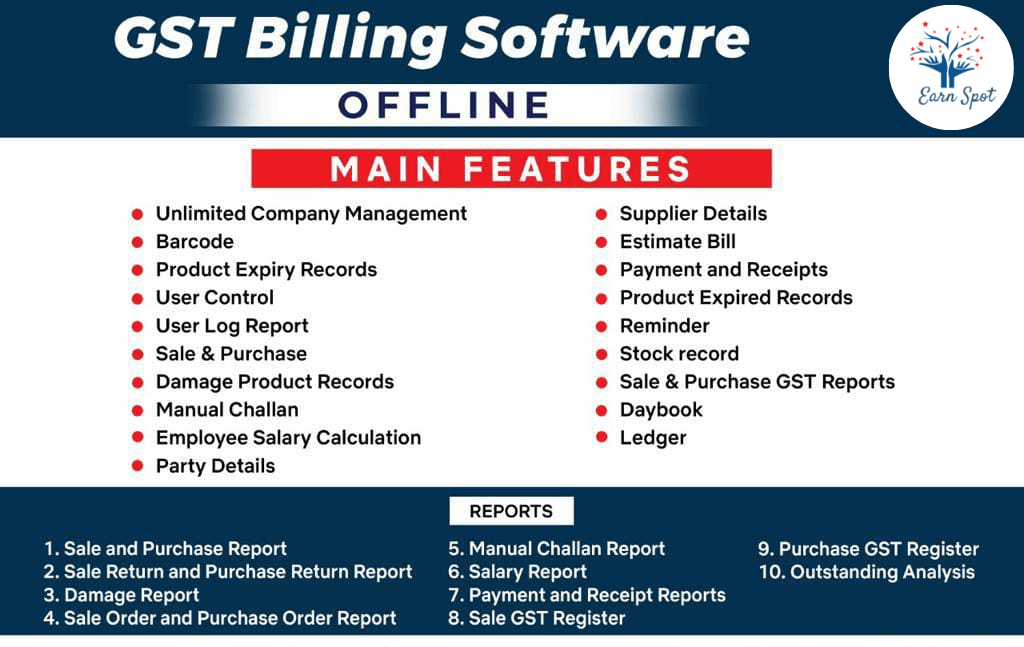

GST Billing Software

Streamline your business with our offline GST billing software. Easily manage GST invoicing, track payments, and ensure compliance without needing an internet connection. Ideal for efficient and reliable billing operations...

Website Design

We create visually appealing, responsive, and user-centric websites that effectively represent your brand online. Our website design services ensure your site not only looks great but also performs optimally...

Digital Marketing

We create and implement targeted Digital marketing strategies designed to boost your brand's visibility, attract a larger audience, and convert followers into loyal customers. Our approach is data-driven, ensuring max...

Whether you’re a startup or a large financial institution, we offer customized solutions to help you navigate challenges, seize opportunities, and stay ahead in a competitive market.

Features That Drive Success in the Finance Industry

Advanced Data Analytics & Business Intelligence

Automation & AI Integration

Cybersecurity & Risk Management

Customer Experience Personalization

Regulatory Compliance & Governance

Mobile and Digital Banking Solutions

Frequently Asked Questions (FAQs)

The finance industry faces multiple challenges, including regulatory compliance, cybersecurity threats, market volatility, technological disruption, and rising customer expectations. Adapting to these challenges requires innovation, enhanced security measures, and personalized customer services.